A RMIS Isn't Enough

Your RMIS Manages Claims.

LineSlip Delivers Strategic Insight.

Your RMIS is essential for day-to-day risk operations. But when it comes to program optimization, renewals, and executive reporting, claims data alone does not tell the full story.

.png?width=228&height=100&name=plus%20content%20(228%20x%20100%20px).png)

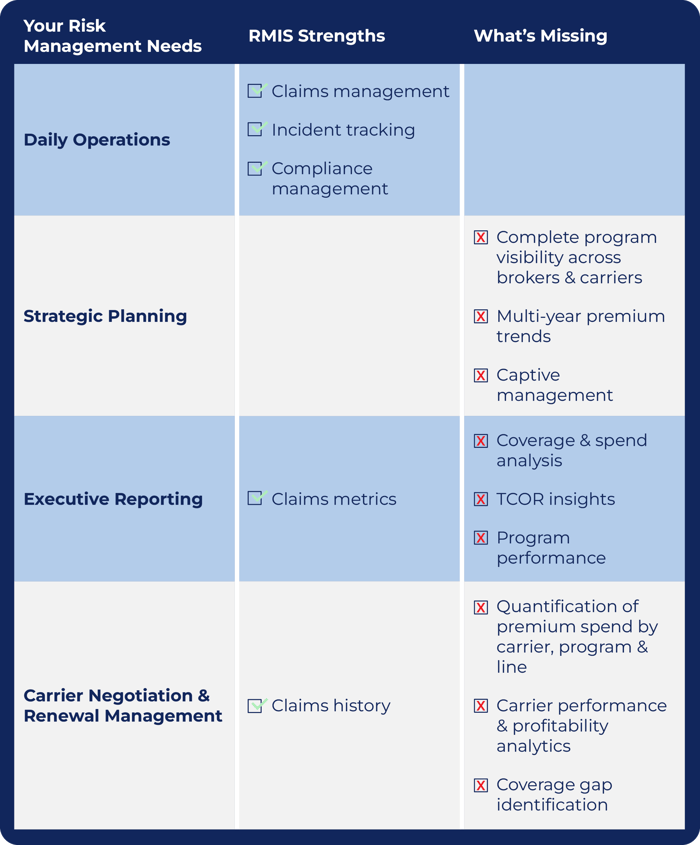

What Your RMIS Does Well (and What It Was Never Designed to Do)

Your RMIS manages what happened. LineSlip optimizes what happens next.

Your RMIS was a smart investment. It centralizes claims, streamlines incident reporting, and supports compliance across the organization.

But RMIS platforms are designed to manage what already happened. They are not built to deliver a complete, forward-looking view of your insurance program.

The result when RMIS is the only system in place? Risk managers still spend days compiling policy data in spreadsheets, the exact manual work RMIS was meant to eliminate.

How LineSlip Complements Your RMIS

Complete Your Risk Management Tech Stack

LineSlip integrates seamlessly with RMIS platforms like Riskonnect and Origami Risk, adding strategic insurance intelligence without disrupting existing workflows.

LineSlip Risk Intelligence automatically:

-

.png?width=48&height=48&name=automated-check_circle+(1).png) Extracts and organizes policy data across carriers and brokers

Extracts and organizes policy data across carriers and brokers -

.png?width=48&height=48&name=automated-check_circle+(1).png) Delivers program-wide analytics on premiums, limits, retentions, and spend

Delivers program-wide analytics on premiums, limits, retentions, and spend -

.png?width=48&height=48&name=automated-check_circle+(1).png) Identifies coverage gaps and optimization opportunities

Identifies coverage gaps and optimization opportunities -

.png?width=48&height=48&name=automated-check_circle+(1).png) Generates executive-ready reports for renewals and stewardship

Generates executive-ready reports for renewals and stewardship

The Integration Advantage:

-

.png?width=48&height=48&name=automated-check_circle+(1).png) Combines RMIS claims data with policy intelligence for full program visibility

Combines RMIS claims data with policy intelligence for full program visibility -

.png?width=48&height=48&name=automated-check_circle+(1).png) Eliminates duplicate data entry through secure API connections

Eliminates duplicate data entry through secure API connections -

.png?width=48&height=48&name=automated-check_circle+(1).png) Adds strategic insight without replacing your RMIS investment

Adds strategic insight without replacing your RMIS investment

Integration Details

How LineSlip and Your RMIS Work Together

-

Automated Policy Intelligence

LineSlip extracts and validates policy data including premiums, limits, sub-limits, retentions, and endorsements.

-

Bidirectional Data Flow

Policy data flows into your RMIS, while claims data enhances LineSlip’s analytics through secure integration.

-

Decision-Ready Visibility

Risk teams gain immediate access to complete, accurate program data for renewals, audits, and reporting.

Customer validation

Real Results from Risk Managers Like You

“The combination is so powerful...It's not just a place where I can go and get data and synthesize data...it's everything and it's operational as well as informational. It becomes an ecosystem...It’s a beautiful thing.”

— D'Juana Thomas, VP Risk Management, Oak View Group

Ready to Add Strategic Intelligence to Your RMIS?

Add LineSlip Risk Intelligence if:

| ■ | You need both operational and strategic program insight | |

| ■ | You want stronger data for carrier negotiations | |

| ■ | You need executive-ready reporting without manual work | |

| ■ | You want to eliminate spreadsheet-driven policy management |

Whether you use Riskonnect or Origami Risk today and want to add strategic capability, we’ll help you build the right solution.