RMIS Integrations

Turn RMIS Data Into Strategic Insurance Intelligence

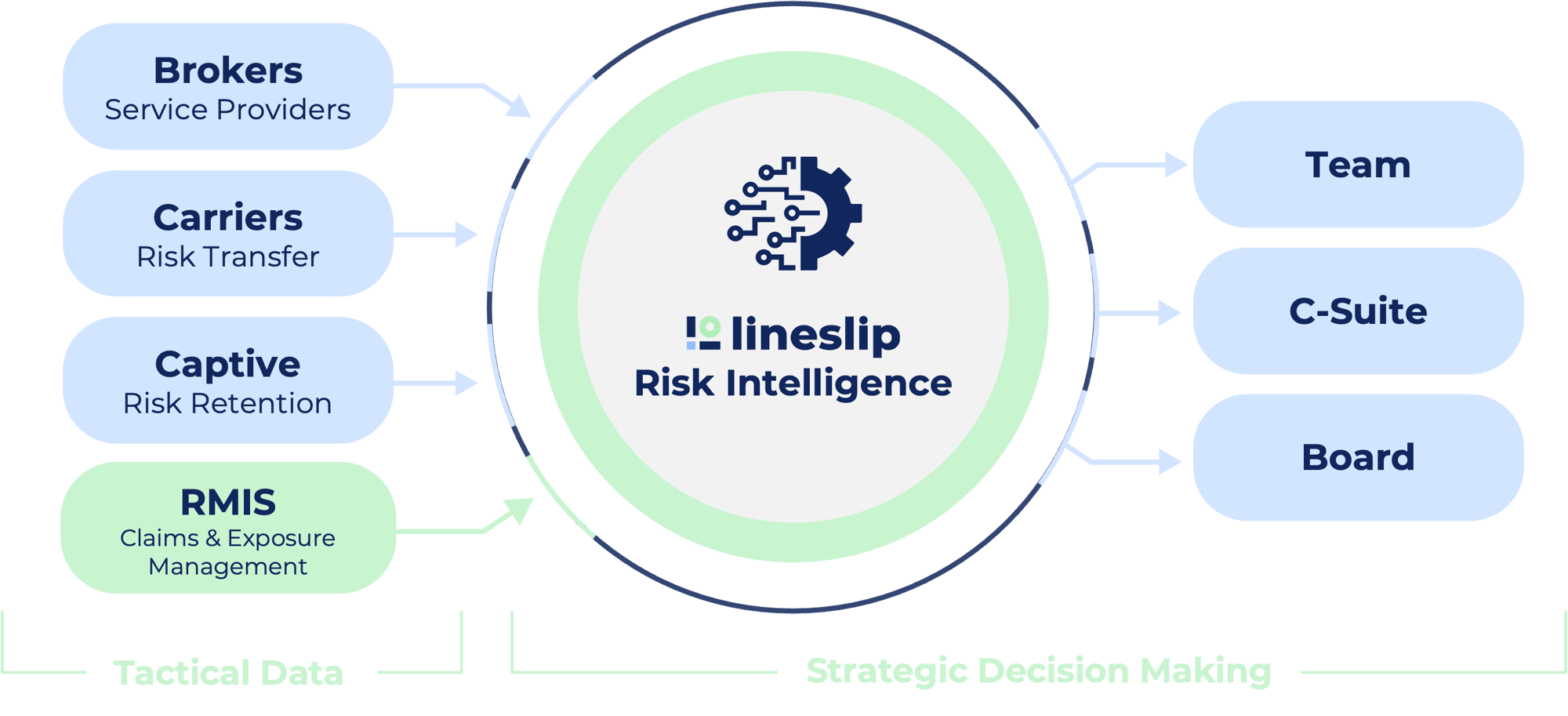

RMIS platforms manage operational risk data. LineSlip completes the picture by transforming fragmented insurance program information into decision-ready insights for renewals, reporting, and executive visibility.

Most RMIS platforms focus on claims, exposures, and operational risk data. Insurance program information often sits outside the system.

LineSlip Risk Intelligence integrates with leading Risk Management Information Systems (RMIS) such as Riskonnect and Origami Risk to automate policy data extraction and deliver a complete, accurate view of your insurance program.

Gain Visibility with Data Analytics

What Becomes Possible With a RMIS Integration

RMIS integrations are not just about eliminating manual data entry. Risk teams gain the clarity they need to make better strategic decisions when they structure, validate, and connect insurance program data to your RMIS.

-

Strategic Risk Management

Combine claims, exposure, and policy data to evaluate program structure, retentions, and total cost of risk.

-

Complete Program Visibility

See premiums, limits, sub limits, retentions, carriers, and brokers in one place without manual updates.

-

Actionable Insights

Create report-ready dashboards for leadership, finance, and renewal stakeholders using trusted program data

-

Decision-Ready Data

Replace static RMIS records with validated data built for renewals, negotiations, audits, and executive decisions.

RMIS Integration

How RMIS Integration Delivers Results

Automated Data Extraction

LineSlip extracts and validates policy data from source documents to reduce manual entry and errors.

Secure Integration Into Your RMIS

Decision-Ready Visibility

Teams gain immediate access to complete program data for renewals, audits, and reporting.

What's the Difference?

Why LineSlip and RMIS Work Better Together

| RMIS | LineSlip | |

|---|---|---|

| Area of Focus | Data centralization, Claims management, Regulatory Compliance, Exposure Management | Insurance program data, including premiums, spend, limits and sub-limits, and retentions |

| Application | Tactical day-to-day operations | Strategic program oversight and analytics |

| Designed for | Claims Adjusters and Risk Managers | Risk Managers, Insurance Managers, and Executive Stakeholders (e.g. CFOs, Treasurers) |

| Insurance Data Handling | Manual Data Entry | Automated data extraction using Machine Learning and human verifcation |

| Insights | Detailed claims analytics | Program-wide insurance analytics |

Not sure where to start - LineSlip or RMIS?

Trying to Decide Which Tech to Prioritize?

Choose a RMIS if...

- You have a high claims volume

- You need a holistic, centralized view of all exposure data across the organization

- You need to integrate your risk data with other internal systems (CRM, ERP, Claims Management Systems, etc.)

Choose LineSlip if...

- You manage a complex insurance program and need clearer visibility for executive decision-making

- You spend too much time on manual policy data work and need faster access to accurate historical program data.

- You need a faster deployment time, and time to value is important

Resources

Resources for Risk Leaders

.png?width=750&height=496&name=Untitled%20design%20(8).png)

RMIS vs Risk Intelligence Platforms: Buyer's Guide

Our comprehensive buyer's guide explains the strategic gap between operational RMIS platforms and Risk Intelligence solutions, and why leading risk teams use both.

.png?width=750&height=496&name=Untitled%20design%20(9).png)

Understanding RMIS vs. Modern Data Analytics Platforms

Our blog helps risk leaders understand the difference between RMIS and modern data analytics platforms. This understanding is crucial for making informed decisions about your risk management technology stack.

.png?width=750&height=496&name=Untitled%20design%20(10).png)

A RMIS Isn't Enough

Your RMIS handles the tactical work like claims tracking, incident reporting, and compliance management. But when it comes to strategic program oversight, managing renewals, and executive reporting, you need more than claims data.

Ready to Revolutionize Your Risk Management?

Learn how LineSlip’s RMIS integration can transform the way you manage your insurance program. Contact us today for a personalized demo.