Insurance Industry Press

Latest press releases, media coverage, and company information providing insights into how LineSlip Solutions is shaping the future of risk management and the insurance industry.

.png?width=500&height=422&name=Screenshot+(109).png)

Prioritizing Cyber Risk Ratings in the Wake of SEC Regulations and Evolving Threats

With increased Securities and Exchange Commission (SEC) regulations, more cyber threats, and evolving technological exposures, all organizations must prioritize understanding their cybersecurity vulnerabilities. Our Vice President of Customer and Product Experience, Jeffrey Sharer, demonstrates how companies can leverage cyber risk ratings to protect themselves in this rapidly changing digital environment while also staying compliant with regulations.

.png?width=500&height=376&name=Screenshot+(86).png)

Is the insurance industry prepared for an unstable marketplace?

"Is the insurance industry prepared for an unstable marketplace?" This is a question that has been on the mind of many people who work in the insurance and risk industry. Unfortunately, the current state of the marketplace reveals a lack of preparedness to effectively navigate through an unstable environment. Our Vice President of Customer and Product Experience, Jeffrey Sharer, shares in PropertyCasualty360 how companies can use technology to differentiate themselves and keep pace with accelerated growth.

.png?width=500&height=376&name=Screenshot+(81).png)

How weather prediction tech creates better risk management

In 2022, the U.S. experienced 18 weather and climate disasters, each costing over one billion dollars. Our Vice President of Customer and Product Experience, Jeffrey Sharer, says that risk managers need improved climate models for better prediction and more accurate pricing of climate risk.

.png?width=500&height=397&name=Screenshot+(82).png)

Attention, real risk managers: Do not try this at work

At RISKWORLD 2023, LineSlip held a drawing of which fictional characters would make the best risk manager. The choices were Dwight Schrute from The Office, Velma from Scooby Doo, and Spock from Star Trek. Read Business Insurance’s hot take on the results of the drawing.

.png?width=500&height=374&name=Screenshot+(53).png)

Digital Insurance: What's ahead for risk managers?

In 2023, risk managers are facing rising inflation, interest rates, and looming threats of worsening conditions. Our CEO, Leo Bernstein, is sharing his top three predictions for what risk managers will be contending with in 2023. He speculates that “risk managers will be looking at rising costs across nearly all lines of business, and will be given the unique challenge of performing complex cost versus benefit analyses on key risks”.

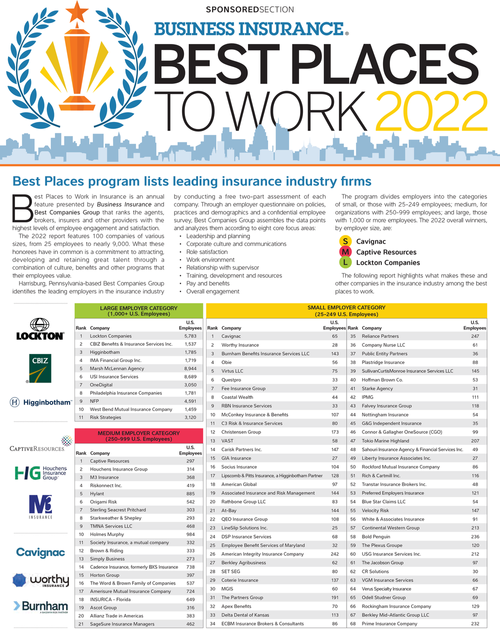

Business Insurance: Best Places to Work in Insurance 2022

Attracting and retaining talent is a strategic imperative for the insurance industry. Best Places to Work in Insurance is an annual feature by Business Insurance and Best Companies Group that lists the agents, brokers, insurers and other providers with the highest employee engagement and satisfaction.

Insurance Edge: Deals: Riskonnect Partners With LineSlip Solutions

Riskonnect, has announced a new partnership with LineSlip Solutions, the leader in insurance technology for extracting and managing insurance program data. LineSlip’s AI technology is now integrated directly into Riskonnect’s Risk Management Information System (RMIS) solution, enabling customers to significantly streamline and automate insurance program management.

Business Insurance 2022 Innovation Awards: LineSlip Total Cost of Risk

The total cost of risk is presented to users, including overheads such as expenses for maintenance, administration and the risk professionals themselves. The idea arose in mid-2021 as a result of client feedback, Leo Bernstein said. It took about six months to craft the software and functionality, which included much work on the client-facing portion of the product, he said.

Healthcare Business Today: 4 Ways To Improve Financial Outcomes By Helping Your Risk Managers

Inflation, rising interest rates, rising costs of litigation, supply-chain squeezes, a pandemic, and labor shortages have all significantly stressed healthcare organizations’ financial plans. Our president, Lee Stevenson, provides some crucial workflows for effective risk management for healthcare organizations and shows where executives and boards can better support the department.

.png?width=500&height=383&name=Screenshot+(27).png)

Risk & Insurance: What Will It Take to Successfully Integrate Insurtech into Commercial Insurance Brokerage? An Acumen for Complexity, Perhaps

“Ten or 15 years ago, the mentality of most brokers was, ‘We’ll build it ourselves.’ And I think that dynamic is shifting rapidly,” said Lee Stevenson, president of LineSlip. “If a broker has something that they believe is proprietary or will give them a competitive advantage, they will more than likely attempt to build. For the non-proprietary, commodity type of stuff, I think what the brokers are finding is it’s more cost-effective to engage with third-party Insurtech.”

Business Insurance 2020 Innovation Awards: LineSlip for Risk Managers

“The platform gives risk managers current information on their insurance placements for reporting, quantifying trading relationships, comparing program performance over time and assessing budget needs. ‘It’s all about understanding their in-force and historical insurance programs, specifically risk-transfer premium and relationships with carriers,’ Leo Bernstein, co-founder and CEO of LineSlip Solutions Inc. said.”

Insurance Journal: LineSlip Streamlines Property Value Reporting, Underwriting Data

“LineSlip Solutions recently unveiled a new tool to help risk managers, insurance brokers, and real estate asset managers streamline the collection and reporting of property values and insurance underwriting data.”

PropertyCasualty 360°: 10 RiskTech Companies to Know in 2020

“The InsurTech company created a framework that uses Natural Language Processing to extract and structure data previously locked in quotes, proposals and other insurance documents. Using that framework, the company's product LineSlip Markets allows brokers to generate proposals and present quote comparisons while collecting, analyzing and using the data generated in the marketing process.”