Insurance Intelligence Built for Risk Managers

Turn Fragmented Data Into Strategic Advantage

Risk managers need reliable data to secure better renewal terms, strengthen negotiating positions, and make confident risk decisions. LineSlip transforms policy documents into the intelligence that makes it possible.

.png?width=1000&height=804&name=MacBook+Air+(15+inch).png)

Why Choose Us

Solve Critical Risk Management Problems

.png?width=1000&height=839&name=tabs-content-1-MacBook-Air-M2+(3).png)

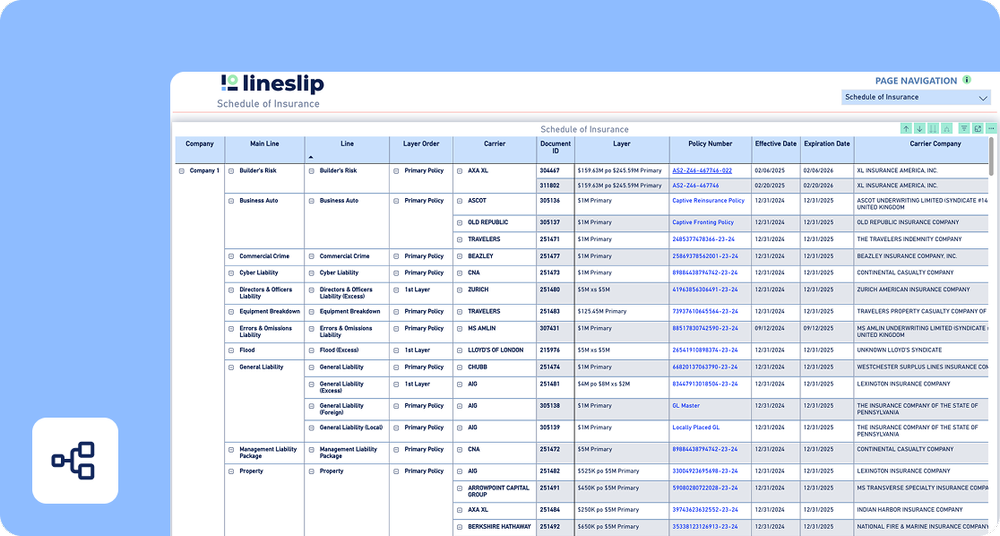

Program Visibility & Control

-

Challenge

Relying on brokers for basic program information and policy documentation across multiple carriers, often waiting days for responses to simple questions.

-

Impact

Limited real-time visibility into coverage details, premium allocation, and program structure delays decision-making.

-

Solution

Centralize insurance program data to give risk managers immediate access to accurate coverage, premium, and policy information.

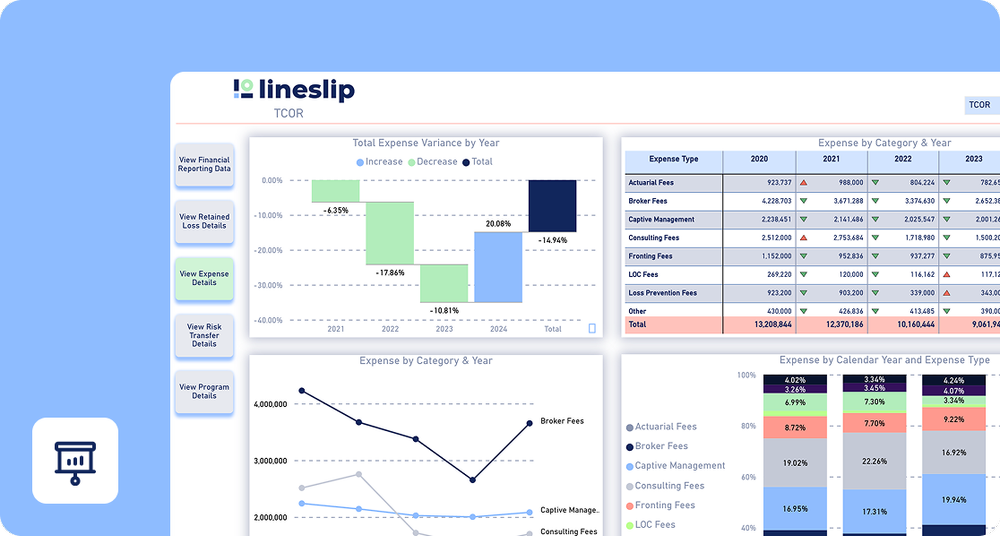

Carrier & Renewal Management

-

Challenge

Managing renewals across carriers and brokers requires manual comparison of binders, policies, and endorsements.

-

Impact

Inability to fully and accurately quantify carrier relationships reduces negotiation leverage, while critical coverage changes are easy to miss, increasing renewal risk.

-

Solution

Automatically track spend, premium trends, and policy changes across carriers to identify leverage points and support confident renewal decisions.

Team Efficiency

-

Challenge

Risk teams spend excessive time reviewing policy documents and responding to internal data requests.

-

Impact

Skilled team members are pulled away from strategic risk analysis and planning.

-

Solution

Automate data extraction and validation to reduce manual review time by up to 85%, freeing teams for strategic risk analysis and planning.

Stakeholder Communication

-

Challenge

Explaining insurance program structure, changes, and costs to executives and finance teams is time-consuming and inconsistent.

-

Impact

Stakeholders lack confidence in insurance data and struggle to understand risk exposure.

-

Solution

Provide clear, structured insurance reporting that enables risk managers to communicate coverage, changes, and financial impact with confidence.

Trusted by Risk Leaders

.png?width=293&height=293&name=SC%20Johnson%20(1).png)

.png?width=293&height=293&name=Labcorp%20(1).png)

.png?width=293&height=293&name=Cigna%20(7).png)

.png?width=293&height=293&name=Sazerac%20(2).png)

.png?width=293&height=293&name=Horizon%20(2).png)

.png?width=293&height=293&name=Crown%20Industries%20(1).png)

.png?width=293&height=293&name=Trinity%20Industries%20(1).png)

.png?width=293&height=293&name=Port%20Houston%20(1).png)

Smart Risk Tools

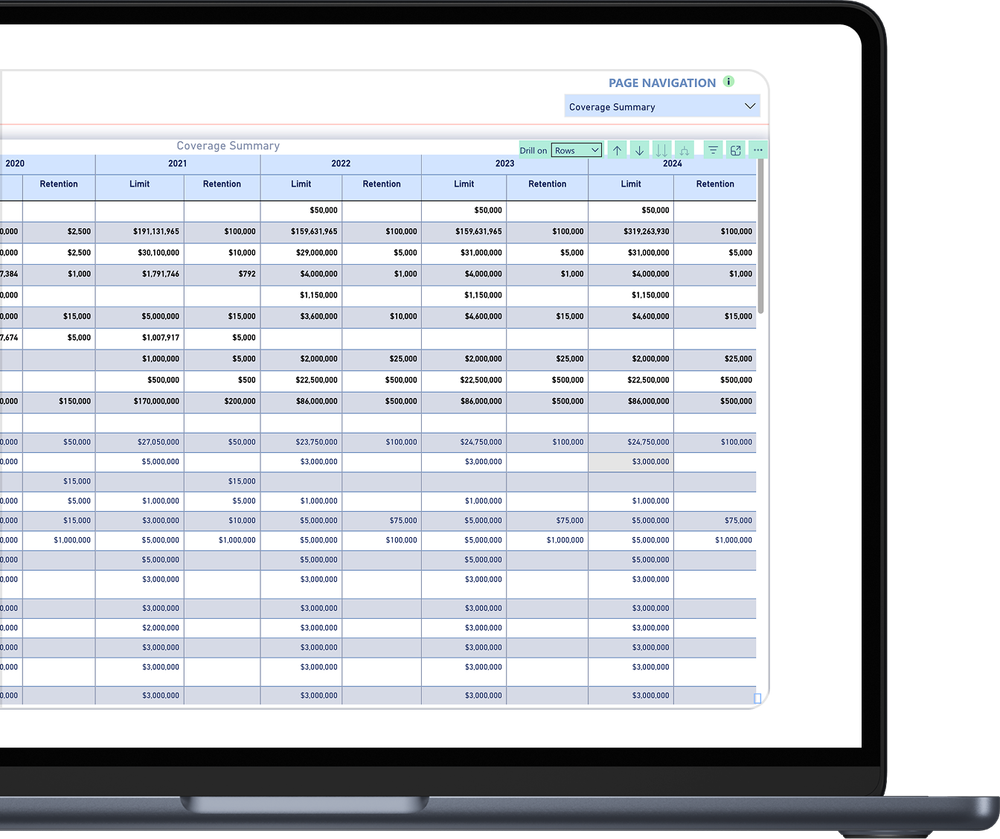

Automated Insurance Data Management. Work Smarter. Not Harder.

AI-Powered Policy Data Aggregation

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Automatic data extraction

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Source document linkage

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Structured data creation

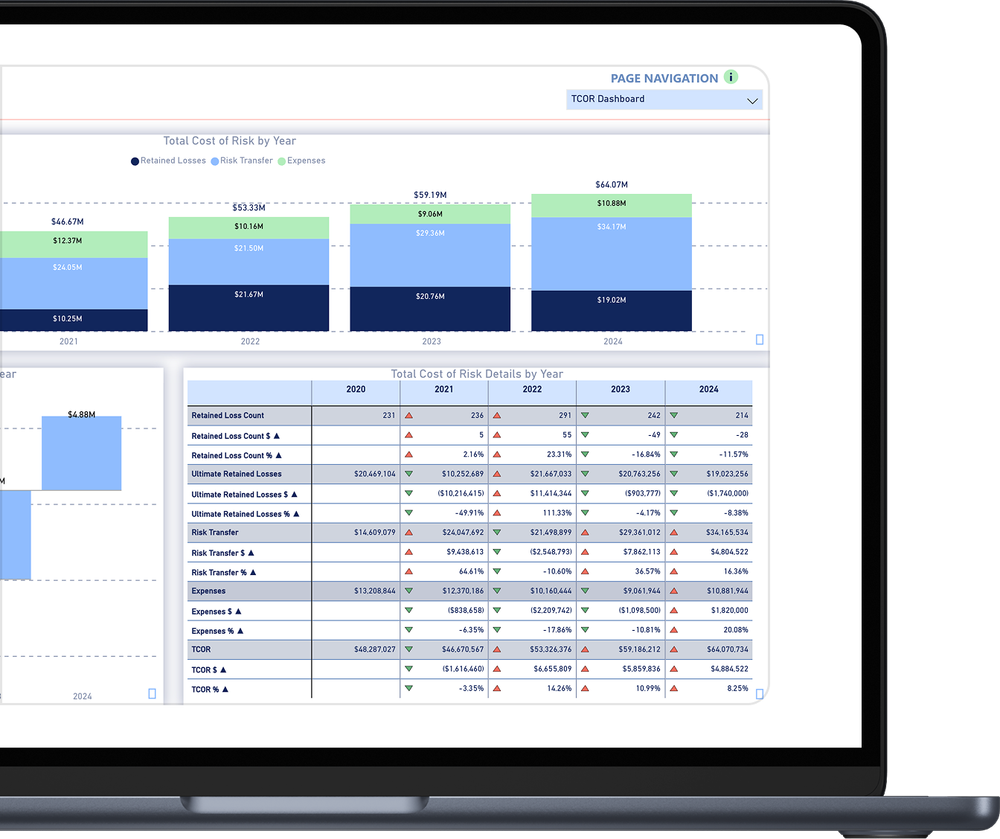

Real-Time Program Dashboard

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Support for the most complex risk programs

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Spend, coverage, limit, retention visualized across all brokers and carriers

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Interactive TCOR analytics

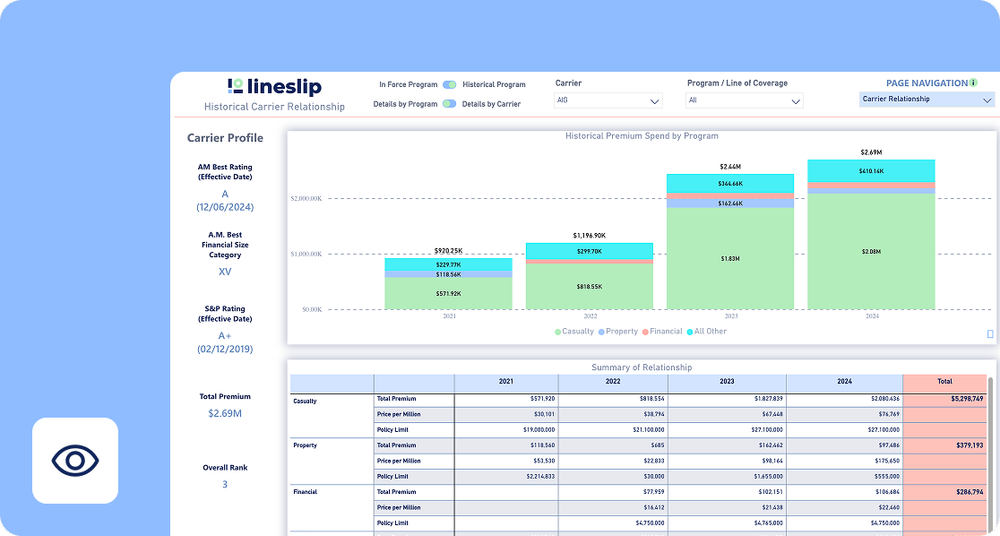

Broker & Carrier Quantification

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Turnkey Stewardship data

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Brokers: Services provided and costs; programs placed analysis

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Carriers: Program, premium and trend analysis

Stakeholder Reporting

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Board-ready visualizations

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Data-driven support for risk retention vs. transfer decisions

-

.png?width=48&height=48&name=automated-check_circle+(1).png)

Proactive management of TCOR

LineSlip Policy Analyzer

Instantly identify critical coverage changes, premium shifts, and policy differences across renewal cycles. Eliminate manual document comparison and validate your coverage automatically.

Transformation

From Data Manager to Strategic Leader

Before LineSlip

-

Hours spent manually consolidating policy data

-

Waiting on brokers for basic information

-

Limited time for strategic analysis

-

Reactive approach to renewals

-

Minimal historical data hampering business continuity

After LineSlip

-

Instant access to program data

-

Complete program visibility

-

Data-driven decision making

-

Institutionalized risk program knowledge

-

Stronger negotiation leverage

Proof Points

Proven Results for Risk Leaders

-

85% reduction in Excel/data entry

-

Real-time management of carrier/broker relationships

-

100% program visibility

-

Comprehensive renewal insights

Steve Cervantes

Credit & Treasury Manager at Viasat

“Without this kind of tool, I would need a new headcount...How else would I handle all the applications, the contract reviews, the certificates of insurance, the broker negotiations? How am I going to handle all that and, at the same time, easily develop summaries of insurance?”

Doug Brauch

Vice President, Treasury & Insurance at Macy’s

“Using LineSlip created an efficient level of organization that we didn’t have...Before LineSlip, it was very time consuming and challenging to aggregate all out programs into a report-ready summary. Now, when an executive calls and asks for a particular detail or something associated with the policy, I’m able to provide answers much more accurately and promptly.”

module

Turnkey implementation easy as 1-2-3

Upload

Upload your program documents onto our secure platform and we do the rest - no manual data keying required.

Visualize

Use the LineSlip dashboard to view insurance summaries, premium/rate comparisons and more.

Access

Digitally-linked and cloud-stored source documents means you can drill down to the original files in seconds.

Ready to Gain Control of Your Insurance Data?

Join risk managers who've eliminated spreadsheets, gained complete visibility, and strengthened their negotiating position.

Resources

Resources for Risk Leaders

Budgeting & Planning Guide

The Ultimate Guide to Planning & Budgeting will give you the process framework you need for more effective yearly planning.

Renewals Management Guide

A Best Practices Guide for Risk Managers walks you through a proven, step-by-step process to simplify renewals, ensure comprehensive coverage, and maximize value.

.png?width=750&height=496&name=Untitled%20design%20(6).png)

RMIS vs Risk Intelligence Platforms: Buyer's Guide

Our comprehensive buyer's guide explains the strategic gap between operational RMIS platforms and Risk Intelligence solutions, and why leading risk teams use both.

Solution Overview

Download the LineSlip Risk Intelligence overview to share with your team.

.png?width=750&height=496&name=Untitled%20design%20(7).png)

Carrier Capacity Report

The Carrier Capacity Report shows which carriers dominate 9 major coverage lines.