LineSlip Risk Intelligence

It’s Time to Upgrade from Spreadsheets to Software

Transform static insurance documents into strategic insights. Get unprecedented visibility into your program and drive maximum value from your insurance decisions.

.png?width=1000&height=804&name=MacBook%2BAir%2B(15%2Binch).png)

Why Choose Us

Overcome Key Risk Management Challenges

.png?width=1000&height=839&name=tabs-content-1-MacBook-Air-M2%2B(3).png)

Program Visibility & Control

-

Challenge

Relying on brokers for basic program information and insurance documents

-

Impact

Delayed decision-making and limited strategic oversight

-

Solution

Instant access to complete program data and insights consolidated across all brokers and carriers

Carrier & Renewal Management

-

Challenge

Limited leverage in carrier negotiations

-

Impact

Suboptimal renewal outcomes

-

Solution

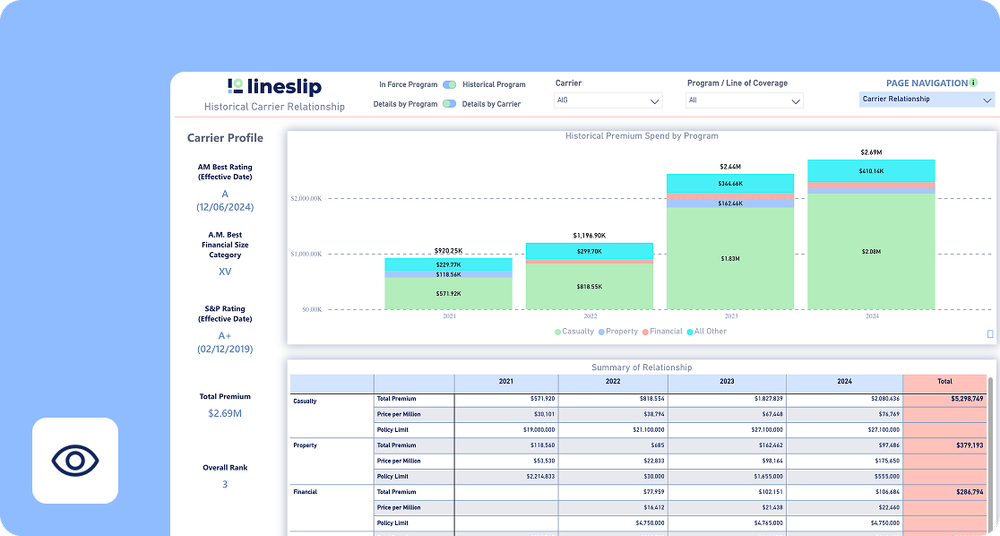

Instant quantification of historical carrier relationships to leverage spend and negotiate better outcomes

Team Efficiency

-

Challenge

Hours spent on manual data entry and verification with minimal team resources

-

Impact

Limited time for strategic initiatives

-

Solution

Automated data aggregation and real-time updates

Stakeholder Communication

-

Challenge

Creating compelling reports for leadership

-

Impact

Difficulty demonstrating strategic value

-

Solution

Board-ready dashboards and instant analytics

Smart Risk Tools

Automated Insurance Data Management. Work Smarter. Not Harder.

AI-Powered Policy Data Aggregation

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Automatic data extraction

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Source document linkage

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Structured data creation

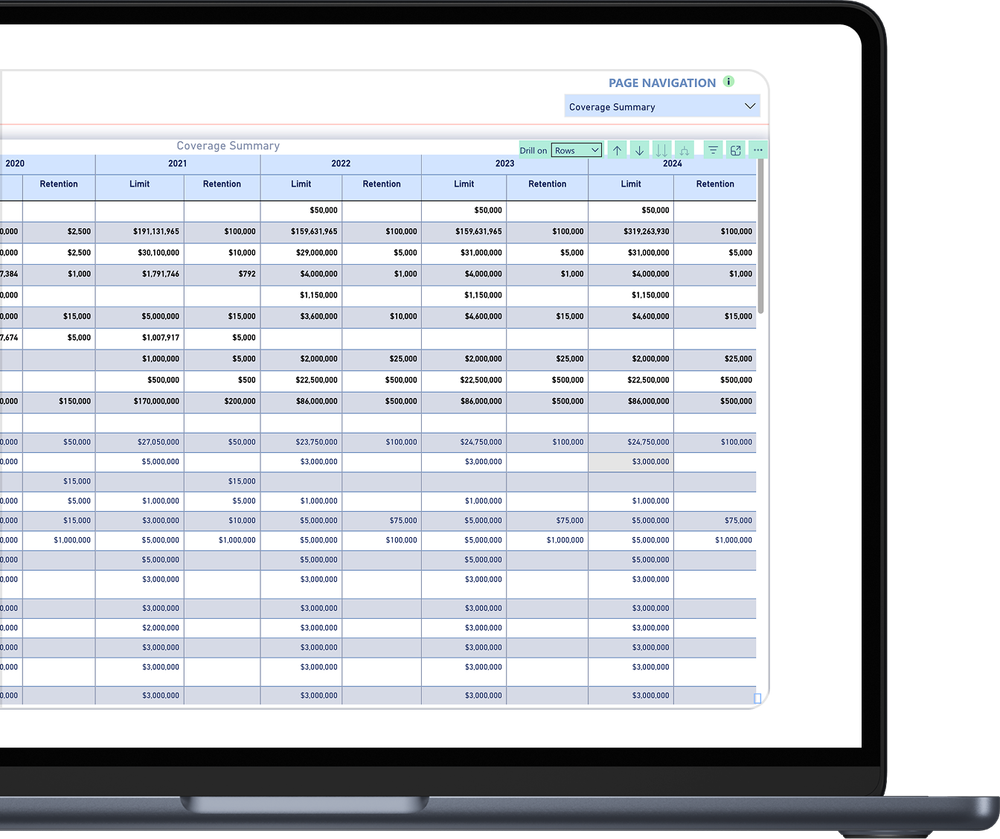

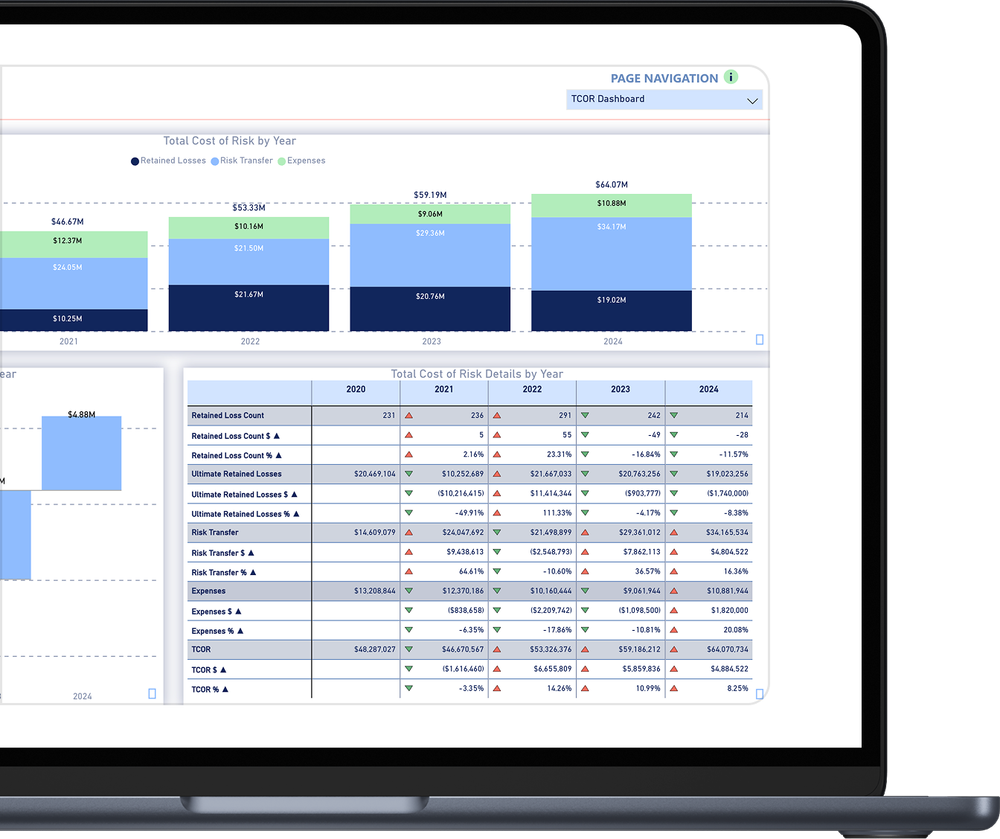

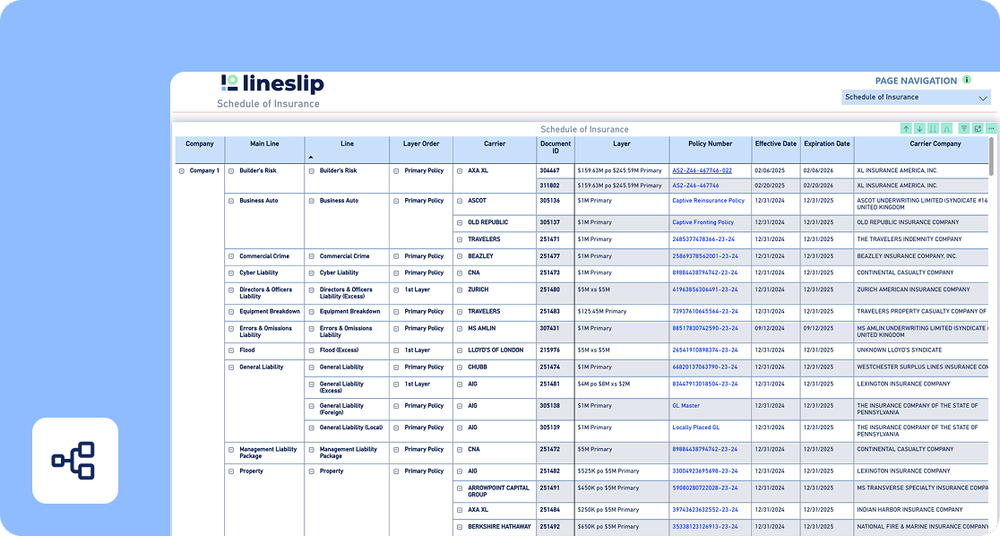

Real-Time Program Dashboard

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Support for the most complex risk programs

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Spend, coverage, limit, retention visualized across all brokers and carriers

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

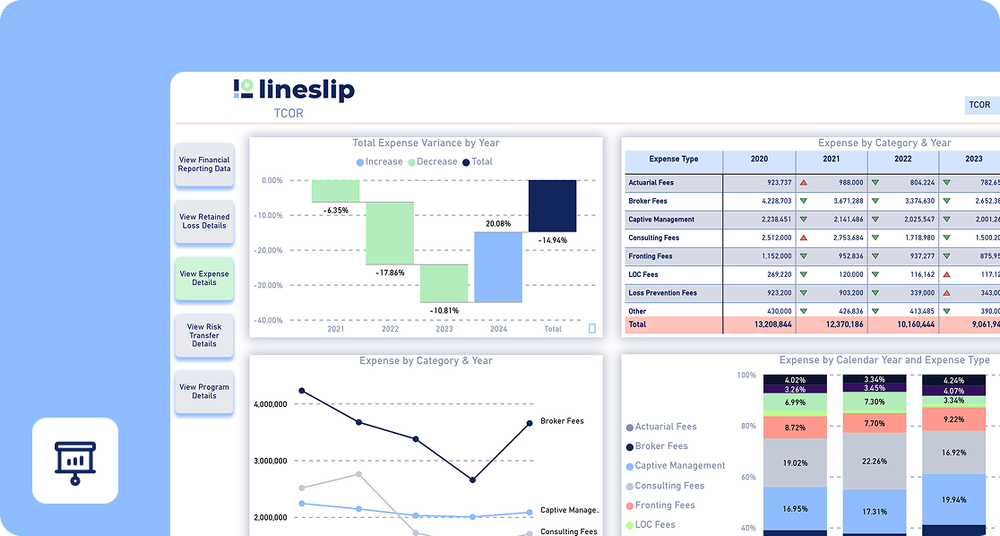

Interactive TCOR analytics

Broker & Carrier Quantification

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Turnkey Stewardship data

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Brokers: Services provided and costs; programs placed analysis

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Carriers: Program, premium and trend analysis

Stakeholder Reporting

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Board-ready visualizations

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Data-driven support for risk retention vs. transfer decisions

-

.png?width=48&height=48&name=automated-check_circle%2B(1).png)

Proactive management of TCOR

Transformation

From Data Manager to Strategic Leader

Before LineSlip

-

Hours spent manually consolidating policy data

-

Waiting on brokers for basic information

-

Limited time for strategic analysis

-

Reactive approach to renewals

-

Minimal historical data hampering business continuity

After LineSlip

-

Instant access to program data

-

Complete program visibility

-

Data-driven decision making

-

Institutionalized risk program knowledge

-

Hours spent manually consolidating policy data

Proof Points

Proven Results for Risk Leaders

-

85% reduction in Excel/data entry

-

Real-time management of carrier/broker relationships

-

100% program visibility

-

Comprehensive renewal insights

Steve Cervantes

Credit & Treasury Manager at Viasat

“Without this kind of tool, I would need a new headcount...How else would I handle all the applications, the contract reviews, the certificates of insurance, the broker negotiations? How am I going to handle all that and, at the same time, easily develop summaries of insurance?”

Doug Brauch

Vice President, Treasury & Insurance at Macy’s

“Using LineSlip created an efficient level of organization that we didn’t have...Before LineSlip, it was very time consuming and challenging to aggregate all out programs into a report-ready summary. Now, when an executive calls and asks for a particular detail or something associated with the policy, I’m able to provide answers much more accurately and promptly.”

Strategic value

Build Your Business Case

Key Benefits for Stakeholders

-

Finance

Clear understanding of cost drivers

-

Executive Team

Effective TCOR reporting

-

Information Technology

Seamless integration with RMIS or data warehouse

-

Operations

Reduced need for support resources

module

Turnkey implementation easy as 1-2-3

Upload

Upload your program documents onto our secure platform and we do the rest - no manual data keying required.

Visualize

Use the LineSlip dashboard to view insurance summaries, premium/rate comparisons and more.

Access

Digitally-linked and cloud-stored source documents means you can drill down to the original files in seconds.

Ready to Transform Your Risk Management Strategy?

Join leading risk managers who have revolutionized their approach to insurance program management.

Resources

Resources for Risk Leaders

Budgeting & Planning Guide

The Ultimate Guide to Planning & Budgeting will give you the process framework you need for more effective yearly planning.

Renewals Management Guide

A Best Practices Guide for Risk Managers walks you through a proven, step-by-step process to simplify renewals, ensure comprehensive coverage, and maximize value.

Solution Overview

Download the LineSlip Risk Intelligence overview to share with your team.