7 Frequently Asked Questions about LineSlip’s Real Estate Offering

LineSlip Real Estate is launching at the end of this month. Before officially launching the new offering, we would like to take the time to answer some frequently asked questions that we’ve received from our launch customers. By answering these questions, we hope to give you a better understanding of our new Real Estate offering and clarify any lingering questions you may have.

1. My portfolio changes throughout the year as we continually acquire or divest properties. How can I track and view these properties?

If you manage a large number of properties for your company or work in the commercial real estate industry, your portfolio is constantly changing. Within a calendar year, you might be acquiring and divesting a multitude of properties across your portfolio.

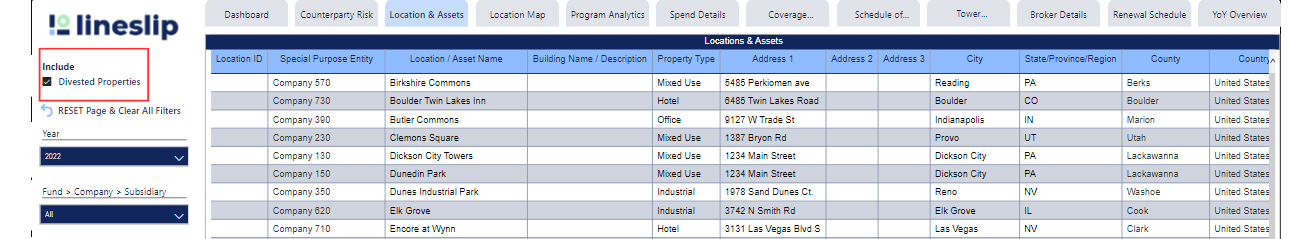

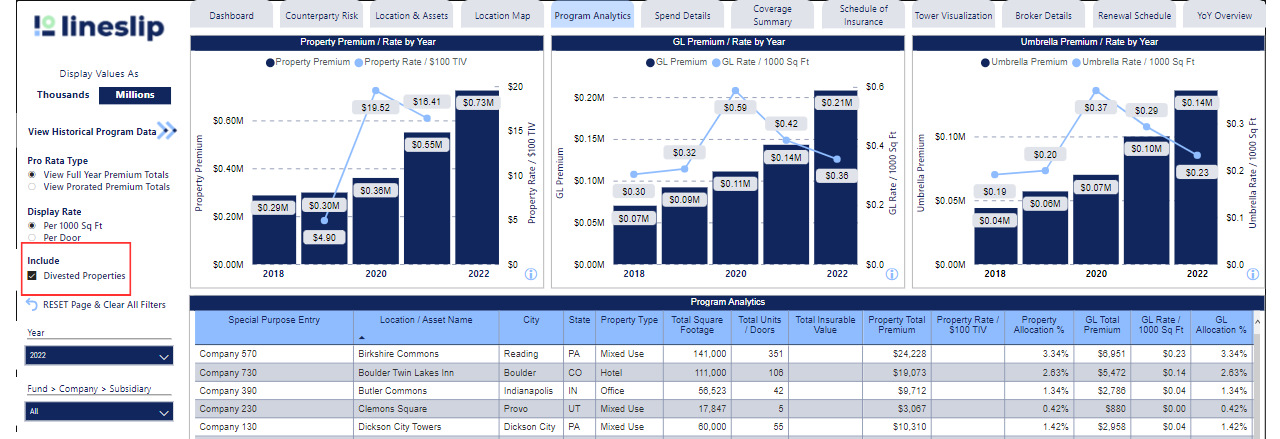

With the knowledge of how dynamic the real estate market is, we want our customers to be able to track the changes in their portfolio easily. In the Real Estate dashboard, you have both the “Locations & Assets” and “Program Analytics” tabs, where you can toggle to view divested properties or visualize prorated premiums for newly acquired or divested properties. This option allows you to view all of your properties within a calendar year or focus on current properties that are still in your portfolio.

“Divested Properties” box in the “Locations & Assets” tab

“Divested Properties” box in the “Program Analytics” tab

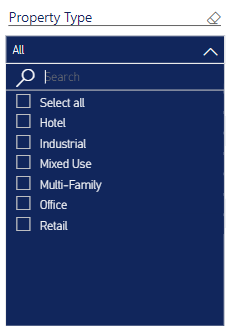

2. How can I focus on a specific property type, such as office locations or retail space?

When you manage a large number of properties, you typically have many different property types in your portfolio. There are certain instances when you need to focus on a specific property type, such as when you need to complete a premium allocation for your properties or if you need to answer questions related to non-commercial portions of your portfolio. With LineSlip, you can apply a “Property Type” filter on the left margin of the page and choose from office, retail, or industrial buildings.

“Property Type” filter

3. Is there a way to display prorated premiums for locations that have divested within a calendar year?

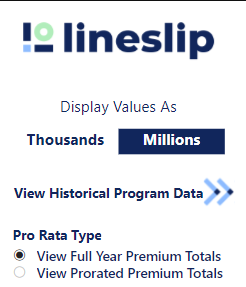

For assets that have divested within a calendar year, you can see prorated premiums reflecting the divestiture. This information is available on the “Program Analytics” tab, where you can select “View Full Year” or “View Prorated” Premium Totals. If you select the “View Prorated” Premium Totals, the analytics will calculate a prorated premium based on the amount of time the property was held within your portfolio.

Select “View Full Year Premium Totals” or “View Prorated Premium Totals”

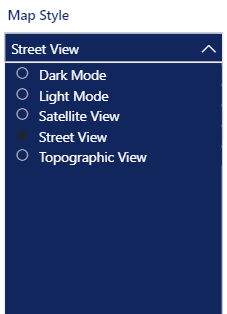

4. I am evaluating renewals for a few locations with a history of a certain type of natural disaster. Is there a way to change the style of map to see the topography or local infrastructure better?

We recognize that everyone has different preferences for how they want to view their information. We considered this when creating our map views and provided multiple options you can choose from, such as street view, satellite view, and topographic view. You can select the map view on the left sidebar.

Different map views to choose from

You can use the street view for a more complete view of roads and infrastructure. And to get an idea of how high or low a property sits in relation to the surrounding area, you’ll want to utilize the topographic view. This information is valuable when evaluating future coverage for your properties.

5. Are there any additional perils planned for future iterations?

In the current version of the Real Estate offering, we can track fires, floods, windstorms, and earthquakes. When our launch customers beta tested the offering, one of the most frequent things we heard was that they wished there were more peril data in the system. Some cited other perils that affect their locations, such as tornadoes in the Midwest; others expressed the need to visualize perils that affect more vulnerable open-air assets like car lots or farms and ranches.

From the very beginning of LineSlip, we have taken all feedback we receive very seriously, as we will continue to evolve our platform to fit the needs of our users. We are planning to include tornado and hail data in a future iteration of our real estate offering. With all the historical peril data at your fingertips, it will be easier for you to pinpoint future risk of perils for your different locations.

6. What is the best tab to view trends over time?

A big part of being a risk manager is identifying trends over time, so you can support your decisions moving forward. If you want to view trends over time in the LineSlip platform, you can do so in the “Program Analytics” tab in the Real Estate dashboard. You can select “View Historical Program Data” on the left-hand margin. Within this tab, there is the “Property Historical Program Analytics” view, which allows you to spot trends in Premium and Total Insurable Value over longer periods of time.

Select “Historical Program Data”

“Property Historical Program Analytics” view

7. Can an internal company identifier represent multiple locations with similar names?

It’s quite common for portfolios to contain multiple businesses sharing the same or similar name. Since the Real Estate dashboard is designed with local and national chain businesses in mind, you have the option to label buildings by any internal company identifier. You can do this in the “Location and Assets” tab in the Location ID or Building ID columns.

“Location ID” column

Whichever way you choose to label the location will be reflected in Real Estate Analytics. This option allows you to pick out the location of your choice from a short list of properties that all share the same name.

In this blog post, we’ve answered some of the frequently asked questions from our launch customers about LineSlip Real Estate offering. We hope this gives you a better understanding of the enhancement and clears up any lingering questions you may have.

If you have additional questions that you didn’t see here, please feel free to reach out to us by emailing us at info@lineslipsolutions.com. We are happy to answer any questions you may have.

We’re so excited to officially launch LineSlip Real Estate so risk managers and commercial real estate asset managers can see what it’s all about!

LineSlip’s Real Estate Launch

To celebrate the upcoming launch of our new Real Estate offering, LineSlip is hosting a virtual Fireside Chat webinar, "The Impact of Environmental Changes on the Property Risk Market," on Tuesday, March 28th, 2023, from 1:00- 2:00 PM EST.

Join our CEO, Leo Bernstein, and his guest, Paul Wasserman (Managing Director – Head of Real Estate Portfolio Management, KKR & Co. Inc.), for a conversation about how environmental changes are impacting the property risk market.

Register here.

/>

/>

.png)

.png)

.png)

.png)

.png)

.png)