Consolidating Insurance Data: Overcoming One of the Biggest Challenges for Risk Managers

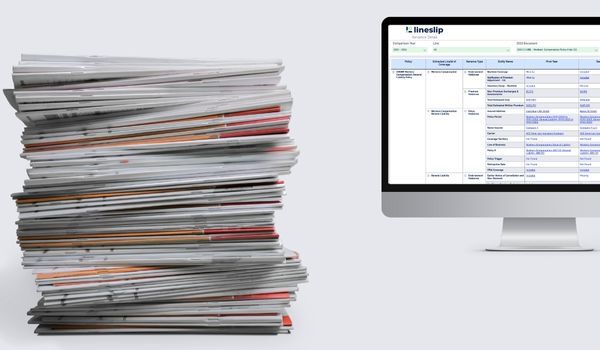

One of the most persistent challenges for risk managers is consolidating insurance program data from multiple sources. Data is often scattered across policy binders, schedules, spreadsheets, and partner portals, making it difficult to gain a comprehensive view of an organization’s insurance coverage.

However, with the right strategies and technology, risk managers can centralize their data, streamline their workflows, and provide more strategic insights to senior leadership.

Why Data Consolidation Matters

Quick access to accurate data is crucial for risk managers in today's fast-paced business environment. They need instant access to key policy information to prepare for renewals, manage claims, and respond to organizational changes like mergers and acquisitions. Consolidating this data saves time and enables risk managers to deliver greater value by providing deeper insights.

Many organizations still rely on outdated processes where insurance data is stored in different locations and formats, leading to data silos, inefficiencies, and an increased risk of errors.

As DeAnn Backus, Strategic Account Manager at LineSlip, explains:

“Risk managers are juggling so many tasks at once with limited time, often short-staffed. Being able to access their data quickly and efficiently is key to helping them manage all of these moving parts.”

The first step in overcoming this challenge is to move away from manual data collection and adopt digital tools that automate the aggregating data from multiple sources into one centralized location, and that are designed specifically for the insurance industry.

Best Practices for Centralizing Insurance Data

To effectively centralize insurance data, risk managers can follow several best practices that simplify and optimize the process:

1. Use a Unified Platform for Data Collection

The most efficient way to consolidate insurance data is by using a platform that aggregates and organizes information from all relevant sources.

Tools like LineSlip automate data extraction from policy documents, schedules, and binders, ensuring all critical information is stored in one location. This eliminates the need for manual entry and significantly reduces the risk of errors, enabling instant access to updated insurance data.

2. Invest Time in Learning New Technologies

While adopting new tools can feel daunting, DeAnn emphasizes that learning how to utilize these platforms fully is essential:

“Whenever someone adopts a new tool or technology, it’s crucial to invest the time to explore its full range of features. This time spent learning will save a significant amount of time down the road and ensure smooth operations.”

Taking the time to familiarize yourself with new technology is an investment that pays off, allowing risk managers to become more efficient and error-free.

3. Standardize Data Formats Across Departments

Many organizations store Insurance data in various formats, from PDFs to spreadsheets. This inconsistency makes it challenging to centralize and analyze data. Risk managers can improve the process by working with departments to standardize formats for storing and sharing insurance information.

Establishing uniform data structures for claims, premiums, and exposure details simplifies the consolidation process, making it easier to analyze and compare data across the organization.

4. Leverage Secure Cloud-Based Solutions for Easy Access

Cloud-based platforms allow risk managers to store and access all their insurance data from anywhere securely. This ensures that critical information is readily available, whether you’re working in the office or remotely. The right cloud solutions can also enhance security and safeguard sensitive insurance data from breaches or loss.

Tools That Help Risk Managers Organize Data

The rapid advancement of technology has introduced tools that make it easier for risk managers to consolidate insurance data. LineSlip is a key solution that uses AI to extract and organize data from various sources into easy-to-navigate, report-ready dashboards.

Cloud platforms like Google Drive and Microsoft OneDrive also help store insurance files in one secure location, and tools like Riskonnect offer policy management solutions to streamline claims processing and reporting.

The Benefits of Consolidating Insurance Data

Consolidating insurance data offers several benefits for risk managers, including:

-

Increased accuracy

-

Faster decision-making

-

Improved business continuity

By centralizing data into a single system, risk managers can ensure that the information they rely on is accurate and up-to-date, allowing quick responses to inquiries, business changes or unexpected incidents.

Additionally, consolidating data helps ensure continuity, particularly as the workforce ages and transitions occur. Risk managers can provide successors with the tools and systems necessary for a seamless transition.

Looking Ahead

Automation and digitization will only get better from here. Consolidating insurance data is no longer just about organizing files—it’s about gaining the insights needed to make smarter, faster decisions.

Risk managers who adopt modern data consolidation tools will be better positioned to manage risk effectively and provide enhanced value to their organizations.

For more information, check out this episode of the LineSlip Unparalleled podcast.

/>

/>